Ajusvera

(Active)

- Shareholder | Account: 42 SHARES. +0

-

6545 viewsWIKIFX: Brown Brothers Harriman (BBH) Capital Partners Invests in The Granite Group

Abstract:As a private partnership, they’re able to take a thoughtful, long-term approach to managing their business and relationships. Their structure promotes client alignment, personal accountability, and agility – so the best ideas rise quickly to the top.

Brown

As a private partnership, theyre able to take a thoughtful, long-term approach to managing their business and relationships. Their structure promotes client alignment, personal accountability, and agility – so the best ideas rise quickly to the top.

With fewer constituencies and no outside shareholders to serve, they have fewer distractions. They can be fully aligned with your best interests, and generous with their expertise and guidance to help you achieve your business objectives. To expands their partnership, BBH Capital therefore Partners completes a Growth Capital Investment in The Granite Group

The BBH Capital Partners (BBHCP) announcement was made on 18th November, 2021 that it has completed a growth capital investment in The Granite Group (Granite or the Company), in partnership with existing management and the Condron family. Founded in 1971 and based in Concord, NH, Granite distributes plumbing, heating, cooling, water, and propane supplies to residential and commercial contractors across New England through 47 wholesale branches and its e-commerce operation. Granite plays a critical role in the market, providing a value-added, in-person experience for the professional segment via a strategically located, customer-centric, and densely distributed branch network that compares favorably to national competitors in the New England market.

While briefing about the investment, the Managing Director of BBH and also the Co- Manager of BBHCP. Brad Langer said

“The investment in Granite is a charming opportunity for BBHCP to partner with another well-managed family-owned and operated business that was requesting a partner to help execute on the next phase of its growth plans,â€. He further said “they were attracted to Granite due to its strategic geographic footprint, established branch network, and well known for best-in-class customer service, technical expertise, and the strength of the management team, led by CEO Bill Condron.â€

Also Senior Vice President of BBH and Principal of BBHCPMatthew Salsbury, added that “Bill and his management team have a long track record of growth and have established Granite as a leader in the New England market. BBHCP is excited to support Granite though its next phase of expansion.â€

Speaking on the matter, Granites President and CEO, Bill Condron. Added that “BBH is well known to the Condron family, serving as the initial banking partner of their founder BBHCP shares their goal of continuing to grow The Granite Group to better serve their customers and create exciting opportunities for their employees.†G2 Capital Advisors served as the exclusive sell-side advisor to The Granite Group on the transaction.

The Granite Group (Granite) distributes plumbing, heating, cooling, water and propane supplies to contractors and fuel dealers across New England through over 47 wholesale branches and their Online Store. The company also operates 15 retail showrooms under The Ultimate Bath Store name, offering an expertly-trained staff to assist with product selection and an extensive array of decorative plumbing fixtures and accessories.

The platform mentioned in the article: https://wap.wikifx.com/en/newsdetail/202112061384513707.html

-

0

0

0

0

- Comments

- No comments yet.

- Shareholder | Account: 42 SHARES. +0

-

6596 viewsWikifx Reviews-Is This Forex Regulatory Inquiry APP Reliable Enough?

WikiFX · Oct 26, 2021 8:26 AM

Abstract:What Wikifx Reviews Say? Are Wikifx Reviews Trustworthy? What Wikifx offers? How Many Brokers Wikifx Include? How Does Wikifx Work?

What Does WikiFX Reviews Say?

This WikiFX review focuses on the brief WikiFX introduction, forex brokers enlisted by WikiFX, as well as some true WikiFX reviews collected from users. WikiFX is an authoritative forex broker and IB query platform, providing information about brokers including regulatory information, risk assessment and WikiFX appraisal, top news of the forex industry, etc. Many sincere users give their WikiFX reviews on how they feel about using WikiFX App, releasing positive WikiFX reviews, as they hold that WikiFX is convenient and easy for them to trace brokers status, checking regulatory information. A large number of WikiFX reviews mention that WikiFX owns big data, all-round information, truly an excellent regulatory information query tool giving stronger persuasiveness and credibility in the credit rating of forex platforms.

image.png

Are WikiFX Reviews Trustworthy?

WikiFX offers a comprehensive evaluation of every broker license, regulation level, software quality, risk-control ability, and business strength to its extensive validity search. All WikiFX pursues is to create a transparent trading condition and ensure traders' fund safety, protecting them from being misled by illegal brokers. As many WikiFX reviews say, big data provided by this App, which can help forex traders find whether a broker is legit or not promptly. The exposure section makes illegal brokers nowhere to hide. Many people may hold that this is overpraised for the WikiFX APP. However, WikiFX reviews are collected based on real user experience. They all agree that WikiFX is an easy and convenient tool to be known by more and more forex traders.

What Does WikiFX Offer?

WikiFX's official website contains quite a few core segments, including “Brokerâ€, “VPSâ€, “Forumâ€, “User Reviewsâ€, “Exposure†sections for forex investors easy navigation. WikiFX love to collect some real reviews from users about their user experience for forex brokers. Additionally, forex investors or traders are welcomed to expose illegal brokers or illegal platforms on the WikiFX website. Many forex investors actively offer WikiFX their reviews that some forex brokerage firms are involved in such scandals as unable to withdraw funds, severe slippage, scam, etc. With so many user reviews, which can significantly help to create a more transparent and safer trading environment.

image.png

Exposure lists from Wikifx Reviews

How Many Brokers Does WikiFX Include?

When it comes to forex brokers enlisted, WikiFX itself provides a huge selection of around 30,000 brokers worldwide. It has collaborated with 30 regulators (including UK FCA, US CFTC, Japan FSA, Australia ASIC, Cyprus CySEC, and more). Forex investors can check up all the relevant information they need to target a reliable broker to invest in to better secure the investment for later. Compared with many other similar platforms, WikiFX is absolutely on top for this part.

image.png

How Does WikiFX Work?

The WikiFX app is easy to navigate, one-click searching brokers, user-friendly. The information about your brokers will be visible in the results. Users can go through this information to understand your forex broker better. Gathering information about a forex broker is not an easy task, for forex trading scams can happen any day. However, WikiFX does a good job of helping people know forex brokers well.

-

0

0

0

0

- Comments

- No comments yet.

- Shareholder | Account: 42 SHARES. +0

-

6629 viewsWIKIFX: FP Markets launches the Share CFDs Directory: A Useful Guide for Share CFD Traders

FP Markets · Dec 6, 2021 4:23 AM

Abstract:The FP Markets operating professional trading experience for a quite long time since the broker was established in 2005 and ever since serves over 12,000 clients worldwide. One of the main strengths is that FP Markets uses true ECN electronic bridges and enhance its proposal with powerful trading technology, also investing in its innovation. Trading with FP Markets you may access to trade 10,000+ products ranging from Forex, Indices, Commodities, Metals, Bitcoin, Equity CFDs markets offers quite competitive spreads. Additionally, users can trade newly launched Share CFDs Directory on October 21st, 2021 as announced on the Broker’s website on which is another key addition to its wide range of trading tools.

FP

The FP Markets operating professional trading experience for a quite long time since the broker was established in 2005 and ever since serves over 12,000 clients worldwide. One of the main strengths is that FP Markets uses true ECN electronic bridges and enhance its proposal with powerful trading technology, also investing in its innovation. Trading with FP Markets you may access to trade 10,000+ products ranging from Forex, Indices, Commodities, Metals, Bitcoin, Equity CFDs markets offers quite competitive spreads. Additionally, users can trade newly launched Share CFDs Directory on October 21st, 2021 as announced on the Brokers website on which is another key addition to its wide range of trading tools.

The newly launched FP Markets Share CFD Directory contains a dedicated page for each Share CFD available to trade at FP Markets via the FP Markets Metatrader 4 & 5 platform. This resource is available for the 800+ Share CFDs offered by FP Markets which covers a wide range of multi-exchange listed companies. Each Share CFD Directory page includes breif information on each listed company including the:

• Company profile

• Share price

• Market sentiment

• Technical Analysis

• Related Company News

This recently made and useful resource adds to an array of trading tools offered to FP Markets traders to enhance their trading experience. Traders can therefore choose from a wide range of sectors and companies on a number of international exchanges such as Rolls Royce Holdings PLC., Paypal Holdings Inc, and a range of Biotech and Big Pharma companies, including Pfizer, Inc. which have proved especially attractive to investors since the pandemic. FP Markets also offers an impressive portfolio of leading global stocks, including Tesla Inc. (TSLA.xnas), Uber Technologies Inc. (UBER.xnys), Apple Inc. (AAPLE.xnas), Netflix, Inc. (NFLX.xnas), Amazon Inc. (AMZ.xnas), – the so-called “FANGs.†In finance, the acronym “FANG†refers to the stocks of four technology companies: Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Google (GOOG).

While Commenting on the progress Craig Allison, Head of Europe, Middle-East, and Africa, said: “their team have created a one-stop source of information for the 800+ share CFDs that FP Markets offers. The interest in equities has reached an all-time high globally and we have added this useful resource to provide each trader with essential information to assist in making informed trading decisions.â€

In addition, to share CFDs, FP Markets offers over 10,000 trading instruments providing traders access to CFDs across Forex, Indices, Commodities, Stocks, and Cryptocurrencies, making it one of the most extensive offerings in the industry and offers eight platforms including MT4, MT5 & Iress.

FP Markets has learned that the combination of consistently tight spreads and fast execution,

Over the past 16 years coupled with cutting-edge platforms, a wide product range, and first-rate customer support are the key ingredients that give serious traders the confidence to trade.

The newly launched Share CFDs Directory tool is available on the FP Markets official website for more details.

The platform mentioned in the article: https://wap.wikifx.com/en/newsdetail/202112067324690686.html

-

0

0

0

0

- Comments

- No comments yet.

- Shareholder | Account: 42 SHARES. +0

-

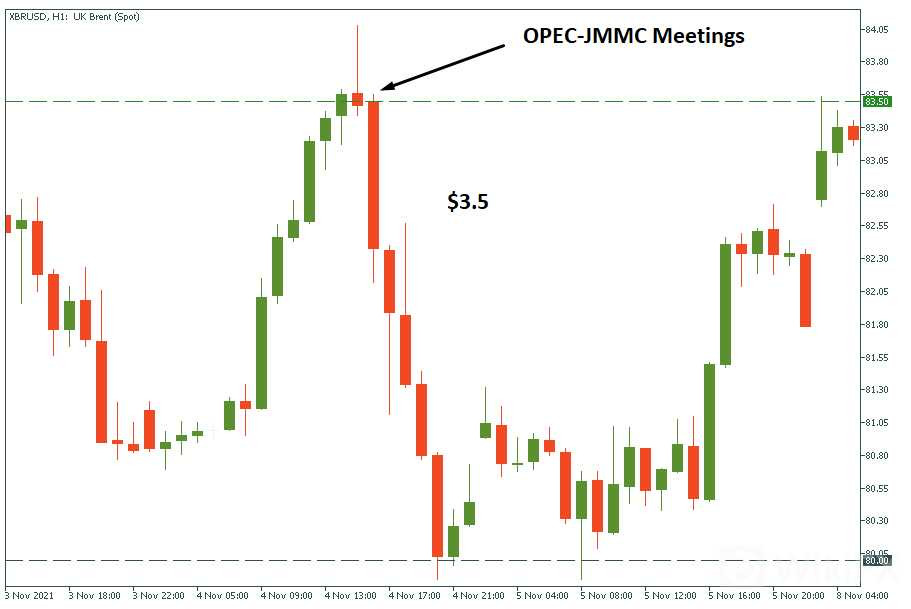

6374 viewsWIKIFX: HOW WILL OPEC-JMMC MEETINGS AFFECT OIL PRICES?

6374 viewsWIKIFX: HOW WILL OPEC-JMMC MEETINGS AFFECT OIL PRICES?

Abstract:The JMMC was established following OPEC’s 171st Ministerial Conference Decision of 30 November 2016 and the subsequent Declaration of Cooperation made at the joint OPEC-non-OPEC ministerial meeting held on 10 December 2016.

HOW

The JMMC was established following OPECs 171st Ministerial Conference Decision of 30 November 2016 and the subsequent Declaration of Cooperation made at the joint OPEC-non-OPEC ministerial meeting held on 10 December 2016.

At the December meeting, 11 non-OPEC oil producers cooperated with the 13 OPEC Member Countries in a concerted effort to accelerate the rebalancing of the global oil market through an adjustment in combined production of 1.8 million barrels per day.

The Organization of the Petroleum Exporting Countries (OPEC) is a permanent, intergovernmental Organization, created at the Baghdad Conference on September 10–14, 1960, by Iran, Iraq, Kuwait, Saudi Arabia and Venezuela.

The two joint organizations OPEC-JMMC arranged a meeting, which will take place on 2nd December, 2021. The meeting may possibly be virtual.

What will happen after the meeting?

The OPEC-JMMC meetings which will be hosted on Thursday, December 2 during the whole day attended by representatives from the 13 OPEC members and 11 other oil-rich nations. They will discuss a range of issues regarding energy markets and, most importantly, agree on how much oil they will produce.

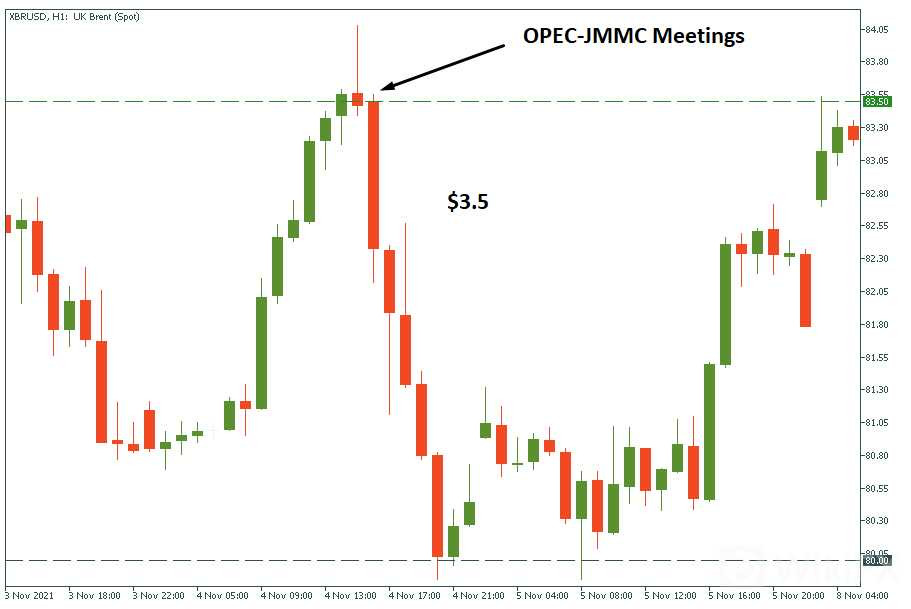

The last time the global supply was not changed, XBR/USD lost $3.5.

To use the OPEC-JMMC meetings and trade, below are the key notes to know?

• If the supply increases, the oil will likely weaken.

• If the supply decreases, the oil will likely strengthen.

Instruments to trade: XBR/USD, XTI/USD.

The platform mentioned in the article: https://wap.wikifx.com/en/newsdetail/202112061894108892.html

- Comments

- No comments yet.

- Shareholder | Account: 42 SHARES. +1

-

6379 viewsWIKIFX :IS BRENT CRUDE OIL PREPARING FOR A LOWER LOW?

Abstract:Brent is the name given to a relatively light crude oil made from a blend of crudes from 19 oil fields in the North Sea. Brent Crude is one of the three main benchmarks for crude oil prices per barrel, along with West Texas Intermediate (WTI) from North America and Dubai Crude from the Persian Gulf. Brent is also the name of an oil field located in the North Sea off the coast of Scotland, which was discovered in 1971 and started production in 1976. Brent is an acronym for Broom, Rannoch, Etive, Ness and Tarbert – the five geological formations that form the Middle Jurassic field.

IS

Brent is the name given to a relatively light crude oil made from a blend of crudes from 19 oil fields in the North Sea. Brent Crude is one of the three main benchmarks for crude oil prices per barrel, along with West Texas Intermediate (WTI) from North America and Dubai Crude from the Persian Gulf. Brent is also the name of an oil field located in the North Sea off the coast of Scotland, which was discovered in 1971 and started production in 1976. Brent is an acronym for Broom, Rannoch, Etive, Ness and Tarbert – the five geological formations that form the Middle Jurassic field.

Brent Crude is a major trading classification of sweet light crude oil that serves as a benchmark price for purchases of oil worldwide.

Taking look at the technical picture of Brent crude oil on the 4-hour chart, it can be observed that currently the commodity is trading below a steep short-term downside resistance line taken from the high of November 10th. The price is also near the 80.83 hurdle, which is the current lowest point of November. Even though Brent oil is showing willingness to move lower, as suggested preferably needs to wait for a break below that hurdle first, in order to get comfortable with lower areas after some Hours.

As the expected drop happens, and Brent oil moves below 80.83, this will confirm a forthcoming lower low, potentially opening the door towards lower areas. The commodity may drift to the 79.58 obstacle, marked by the low of October 7th, where a temporary hold-up might occur. Nevertheless, if the selling pressure remains strong, the price could continue sliding, possibly aiming for the 78.24 level, marked by the lowest point of October. The RSI and the MACD are currently pointing lower. In addition to that, the RSI sits below 50 and the MACD continues to run below zero and the trigger line. The two indicators show negative price momentum, which supports the above-discussed scenario.

In other way round, when the price breaks above the aforementioned downside line and then climbs above the 83.10 barrier, marked by the high of November 12th, that could attract a few more buyers into the game. Brent oil might then travel to the 83.82 obstacle, or even to the 84.68 territory, which is marked near an intraday swing high of November 9th and an intraday swing low of November 10th. If the buying fails to stop there, the next possible target could be the 85.58 level, marked by an intraday swing high of November 10th. Over there the commodity may test a short-term uncertain downside resistance line drawn from the high of October 25th, and it may likely provide an additional hold-up.

The platform mentioned in the article: https://wap.wikifx.com/en/newsdetail/202112069494530812.html

-

1

1

0

0

- Comments

- No comments yet.

- Shareholder | Account: 42 SHARES. +1

-

6392 viewsWIKIFX :PGIM Private Capital invests $65.0M in ED&F Man Capital Markets US Holdings

Abstract:ED&F Man Capital Markets is a global financial brokerage and trading business and the financial services division of ED&F Man Group. As one of the world’s leading brokers, with 230 years of heritage, a vastly experienced team of trading experts and market-leading brokerage technology solutions, we are ideally placed to service our clients’ needs, while maintaining a focus on our business values of integrity, client care, careful risk management and upholding the highest standards of regulatory compliance.

PGIM

ED&F Man Capital Markets is a global financial brokerage and trading business and the financial services division of ED&F Man Group. As one of the world‘s leading brokers, with 230 years of heritage, a vastly experienced team of trading experts and market-leading brokerage technology solutions, we are ideally placed to service our clients’ needs, while maintaining a focus on our business values of integrity, client care, careful risk management and upholding the highest standards of regulatory compliance.

PGIM is the new renamed of Prudential Capital Group given to its global investment business as PGIM Private Capital. With over $86 billion in assets under management (as of March 31, 2019), the business is the private capital arm of PGIM, the $1.2 trillion global investment management business of Prudential Financial, Inc. (NYSE: PRU). PGIM Private Capital provided a $65.0M Senior Secured Credit Facility including of a $50.0M Senior Secured First Lien Term Loan and a $15.0M committed Delayed Draw Term Loan to ED&F Man Capital Markets US Holdings, Inc., a global financial brokerage business.

PGIM is pleased to announced it's offer to fund ED$F Man Capital Markets in providing strategic financing for the business as they pursue next phase of development. While Commenting on the topic, the Vice president of PGIM Private Capitals Directing Lending group, PJ LaFemina said:

“ their experience with similar financings in this sector introduced them to the opportunity to work with the Firm‘s management team, forming a strong, direct partnership. Also their relationship-oriented approach is reflected in the Firm’s mission centered on integrity, trust, client care and astute risk management,â€.

Additional statements made by Matthew Harvey, Managing Director and Head of PGIM Private Capitals Direct Lending group, said:

“they look forward to supporting ED&F Man Capital Markets‘ strategic journey and working closely with their leadership team. Their Direct Lending strategy is based on close, long-term relationships with strong management teams, which was reflected through the Firm’s outstanding leadership. Their thorough understanding and experience with financing strategies and flexible structures enabled them to provide a valuable solution as ED&F Man Capital Markets further invests in their business.â€

After exchanging word of pleasantries as a result of Their partnership, each described from their view what they believed has made their partnership great and beneficial, Given additional remark by the Global CEO of ED&F Man Capital Markets, Christopher J Smith said: “their partnership with PGIM Private Capitals Direct Lending group is built on a relationship whose foundations go back over many years. The provision of $65m of strategic financing will enable them to leverage the significant opportunities they observed as a leading provider in global capital markets operating at the heart of the financial services ecosystem. Their Firm has a resilient and proven track record, a highly executable strategy, and clear vision for the future This facility will enable us to develop and achieve our financial and strategic goals.â€

All the two partnering companies had therefore accepted their terms and conditions and agreed on their business partnership and funding opportunities to help the speedy development of their company.

-

1

1

0

0

- Comments

- No comments yet.

- Shareholder | Account: 42 SHARES. +1

-

6491 viewsWIKIFX :XM Donates to Non-Profit Organisation Misr El Kheir to Fund Clean Water

XM · Dec 7, 2021 7:37 AM

Abstract:XM.com as a Broker, Offer a range of Account types and a low minimum deposit to appeal to all levels of trader. With 1000+ markets and low spreads they offer a great service. Trading Point of Financial Instruments Pty Ltd was established in 2015 and is regulated by the Australian Securities and Investments Commission (ASIC 443670). XM offers trading in currencies, CFDs on stocks, commodities, precious metals, energies, as well as equity indices & these can be traded on their MT4 & MT5 trading platforms.

XM.com as a Broker, Offer a range of Account types and a low minimum deposit to appeal to all levels of trader. With 1000+ markets and low spreads they offer a great service. Trading Point of Financial Instruments Pty Ltd was established in 2015 and is regulated by the Australian Securities and Investments Commission (ASIC 443670). XM offers trading in currencies, CFDs on stocks, commodities, precious metals, energies, as well as equity indices & these can be traded on their MT4 & MT5 trading platforms.

Apart from the brokerage offers, XM also offers some donation to help execute other services that will enable them obtain recognition. Recently the XM broker has announced that they have donated to the non-profit organization Misr El Kheir to support their work in delivering clean drinking water to rural areas and villages in Egypt.

The donation will help them get access to clean water in rural Egypt is an ongoing problem, with millions still not having a safe water supply. Lack of clean water results in poor sanitation and the spread of illnesses which are especially fatal to children.

Misr El Kheir Foundation (MEK) is a non-profit development institution established in2007 with the objective of developing the Egyptian individual in a comprehensive manner. Five key areas have been selected for human development namely: Health, Education, Scientific Research, Social Solidarity and Aspects of Life. Misr El Kheir has a well-established program in place to deliver clean drinking water to villages where the inhabitants cant easily access it. It is an incredibly important project and we would like to applaud them for the essential work they do and their efforts to improve the lives of those less fortunate.

XM Broker, believes that everyone deserves the right to clean water and other basic necessities. And they will remain committed to supporting communities around the world and donating to those who are focused on making the world a safer and fairer place to live for Humans.

The platform mentioned in the article: https://wap.wikifx.com/en/newsdetail/202112319404425345.html

-

1

1

0

0

- Comments

- No comments yet.

- Shareholder | Account: 42 SHARES. +1

-

6611 viewsWIKIFX: How to make money in foreign exchange trading

6611 viewsWIKIFX: How to make money in foreign exchange trading

WikiFX | 2021-12-28 10:21:31

What is a stock exchange?

How does the foreign exchange market work?

In the currency exchange market, different currencies are bought and sold.

Trading in the foreign exchange market is easy. Trading mechanics are similar to those in the rest of the financial markets (like commodity markets), so if you have any knowledge or experience in trade, you will immediately understand what it is like.

image_stage1.0.png

Even if you do not know anything about it, you will soon understand harkar. Once you have completed the School of Pipsology, the financial business training program we provide.

The purpose of the exchange market is to exchange one currency for another while the price is expected to change.

In particular, that the money you buy will add value to the money you sell.

Here is an example.

image_stage1.0.png

* EUR 10,000 x 1.18 = US $ 11,800

** EUR 10,000 x 1.25 = US $ 12,500

Simply put, the price of a change is to compare the value of one currency over another currency.

For example, the USD / CHF exchange rate indicates the amount of US dollars you can buy for one Swiss currency, or the amount of Swiss currency you need to buy for one US Dollar.

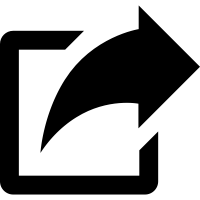

How to read the foreign exchange market

Currency pairs are usually listed in two currencies, such as GBP / USD or USD / JPY.

The reason they are priced in pairs is that, in each exchange transaction, one currency is bought and another currency is sold at the same time.

How do you know how much to buy and who to sell?

Good question! Here is where the issue of funding base and rates are priced came.

Funded and subjective fees

Whenever you have an open market in the foreign exchange market, you are exchanging one currency for another currency.

Fees are charged in relation to other fees.

Here is an example of the exchange rate of the British Pound against the US Dollar:

image_stage1.2.png

The first currency from the right and left is called the base currency (British pound in this example).

The underlying currency is an important indicator of the exchange rate fluctuations of the two currencies. It always has the same value.

At the time of purchase, the exchange rate refers to the amount of items you have to pay in the proportion of the cost of purchasing one share of the base price .

In the previous example, the exchange rate refers to the percentage of the value proposition that you will receive if you sell one share of the base currency.

In the previous example, you would earn US $ 1.21228 if you sold 1 British Pound .

base funds represent the total amount of capital funds required to obtain a single share of base funds.

If you buy EUR / USD it means that you are buying the underlying currency and at the same time you are selling the underlying currency. In the original language, "buy EUR, buy USD,"

You will buy a double bond if you believe that the underlying funds will increase in value in terms of cost savings.

You can sell a double bond if you think that the underlying funds will break down in terms of cost savings.

Given that there are two major trading currencies, how do exchange brokers know which currencies to invest in as well as what currencies to deposit?

Fortunately, the exchange rate has been adjusted in the exchange market.

You can note that prices are denominated as a series of two currencies that are separated by a constant ("/").

Be aware that this is a matter of choice and can be removed or replaced with height, horizontal or vertical position.

For example, some traders may write "EUR / USD" as "EUR-USD" or simply "EURUSD". They all mean the same thing.

"Long" and "Short"

image_stage1.3.png

First, decide whether you want to buy it or not.

If you want to buy it (which means buying base money and selling it at a high price), you want the stock to be worth it and then buy it at a high price.

In the business world, this is called "long walk" or "long walk " .

Remember: extension = purchase

If you want to sell (which means selling base capital and buying higher prices), you have to base your values ​​and then sell them at a higher price.

This is called a "short walk" or "short stop" .

Remember: short = sale

image_stage1.4.png

I am tall and short.

Spread out or Murabba'i

If bakada positions in the open , is called the "flat" or "square" .

"Closing the position" is called "gathering squares" .

image_stage1.5.png

"I am a square."

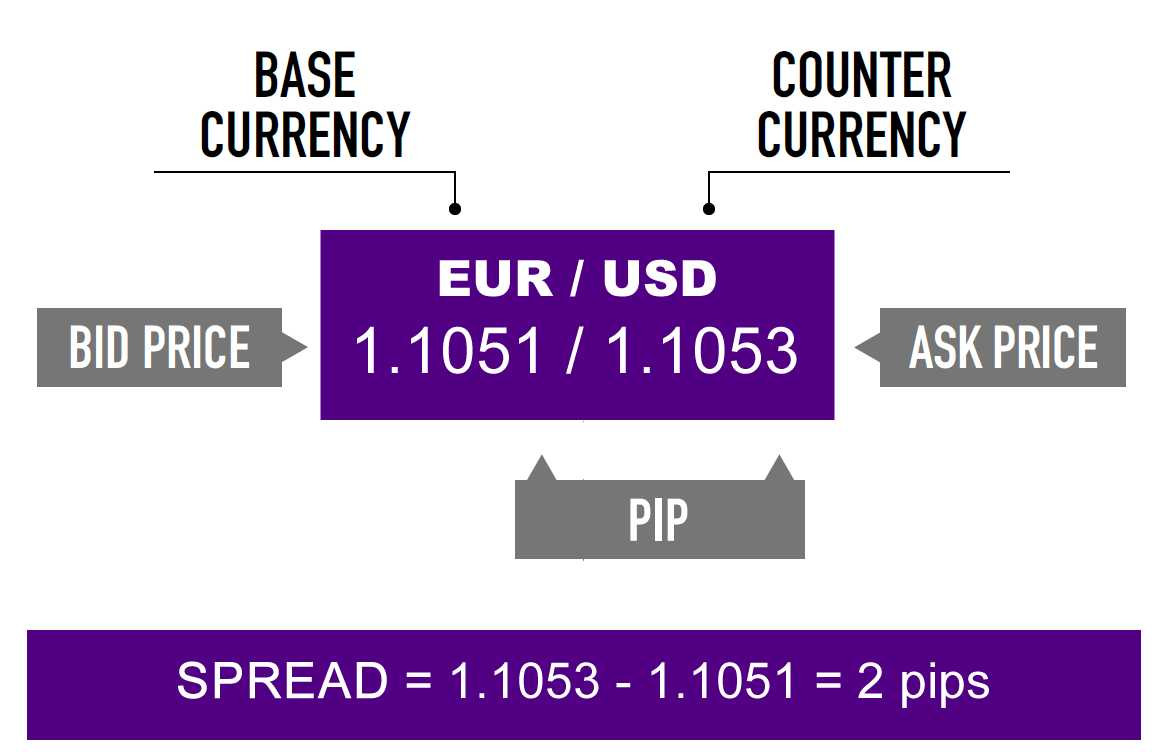

Pricing, Question and Layout

Generally the exchange market price is priced in two ways: pricing and query prices .

In general, the price quoted does not reach the asking price .

image_stage1.6.png

What does pricing mean?

Pricing is the price at which the broker intends to purchase the underlying funds for the exchange of valuables.

This means making the price is the best price you (the dealer) can make in the market.

If you want to sell something, the dealer will buy it from you at a fixed price.

What is the “Question Price�

The question is the price the dealer will sell the funding base exchange fees the cost.

This means the query price is the best price you can buy in the market.

Another term also refers to the question of whether the price is intentional .

If you want to buy something, the seller will sell it (or offer it) to you at the asking price .

What does "Bed" mean?

The difference between the price and the asking price is called SHIMFIDA .

At EUR / USD exchange rate above, the quoted price is 1.34568 and the asking price is 1.34588. take a look at how this broker makes it easy for you to leave your money.

If you want to sell the EUR, click on the "Sell" icon and sell your euro at 1.34568.

If you want to buy EUR, click on the "Buy" icon and buy the euro at 1.34588.

Here is a sample summary of what we have discussed in this lesson.

image_stage1.7.png

- Comments

- No comments yet.

- Shareholder | Account: 42 SHARES. +1

-

6613 viewsWhat is trading in Forex?

6613 viewsWhat is trading in Forex?

WikiFX | 2021-12-27 16:21:05

What is trading in Forex?

The simplest answer is MONEY . Meaning international currencies.

Because something is not really bought, the business of change is a bit complicated, so we will use a simple example to help explain it.

You have determined that the purchase money as purchasing shares in a land , like purchasing shares in the fabric.

Pricing usually refers to the market view on the quality of the current and future market economy.

In the foreign exchange market, for example, the Japanese currency (yen), you have no choice but to buy shares in the Japanese economy.

mkr.jpg

You are convinced that Japan's economy is doing well and that there will be future growth.

If you sell these "stocks" in the market, you are expected to make a profit.

In general, exchange rate fluctuations reflect the economic situation of this country on the economies of other countries.

By the time you graduate from Pipsology , you will be ready to work with different national currencies.

Big Money

Just as there are many currencies that you can trade, as a new exchange trader, it is possible to start a business with large "funds".

mkr.jpg

They are called "big currencies" because they are the most traded currencies and some of them represent the largest economy in the world.

Currency traders have disputed over what they call Big Currencies.

As a rule of thumb, law enforcement like children consider the USD, EUR, JPY, GBP, and CHF as major currencies.

They then called the AUD, NZD, and CAD "stocks" .

In our case, the rebels, in order to alleviate the situation, simply call the eight coins "big bucks."

Below, we list them with their symbols, Countries used, currency names and interesting game names.

mkr.jpg

mkr.jpg

Currencies are marked with "three letters" , the first two letters indicate the name of the country in which they are used, and the last letter indicates the currency of the country in which they are used, usually referring to the first letter of the national currency.

These three letters are called ISO 4217 Currency codes .

In 1973, the International Organization for Standardization (ISO) issued three letters as the currency symbols we use today.

mkr.jpg

Take the NZD for example ……

NZ means New Zealand, and D means dollar.

It's easy, isn't it?

The currencies in this map are called “Big Currencies†because they are the most traded currencies.

Do you know? The British pound (pound) is the oldest currency in the world and has been in use since the 8th century. The new currency in the world is the South Sudan Pound, officially confirmed on July 18, 2011.

It is almost certain that "buck" is not the only game name for USD.

There are others like: greenbacks, bones, benches, benjamins, cheddar, paper, loot, cheese, bread, moolah, dead president and cash money.

So if you want to say "Now I'm going to work"

You can say, “Yo, I gotto bounce! Gotto make benjis son! â€

Have fun: In Peru, the name of the US dollar game is Coco, the animal name is Jorge (George in Spanish), which means a $ 1 note on George Washington's $ 1 note.

mkr.jpg

They call me Coco yo!

Stem

- Comments

- No comments yet.

- Shareholder | Account: 42 SHARES. +1

-

6616 viewsFBS Oceania:THE FOMC BRINGS NEW INSIGHTS FOR THE USD

FBS Oceania · Dec 7, 2021 7:31 AM

Abstract: The Federal Open Market Committee (FOMC) is the branch of the Federal Reserve System that determines the direction of monetary policy specifically by directing open market operations. The FOMC is composed of the Board of Governors, which has seven members and five Federal Reserve Bank presidents.

THE

The Federal Open Market Committee (FOMC) is the branch of the Federal Reserve System that determines the direction of monetary policy specifically by directing open market operations. The FOMC is composed of the Board of Governors, which has seven members and five Federal Reserve Bank presidents.

As the monetary policy body, The United States will publish the Federal Open Market Committee Meeting Minutes on November 24, at 21:00 GMT+2. This is a detailed report of the previous Fed's meeting that contains in-depth insights into the economic and financial conditions.

It is important to come up with report, As the market awaits the beginning of tapering and hawkish steps by the Federal Reserve, traders will be looking for a shift in the forecast for the next rate hikes, changes in the economic outlook, and, most importantly, the views on inflation. If the Federal Reserve confirms high inflation and makes steps towards tightening, the USD will gain.

How to trade on the FOMC Meeting Minutes?

For you To trade on this event, you need to follow the details in the news and on the official site of the Federal Reserve.

• If the Federal Reserve is hawkish, the USD will strengthen;

• On contrary, cautious comments will make the USD weaker.

The platform mentioned in the article

-

1

1

0

0

- Comments

- No comments yet.

- Shareholder | Account: 42 SHARES. +1

-

6790 viewsWIKIFX:Trading schedule for the 2021-2022 Winter Holiday · Jan 5, 2022 1:05 PM

Abstract:Please be aware of the trading schedule changes for the 2021 Christmas and New Year holiday period (all times are GMT+2):

FXOpen as a retail and institutional forex broker offering online trading services via MetaTrader 4, MetaTrader 5 and TickTrader trading platforms. It also provides access to the electronic communication network to execute trades in currency pairs. FXOpen EU is a trading name of FXOpen EU Ltd. FXOpen EU Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 194/13.

WikiFX,

The Broker is hereby informing trades about the recent trading schedule changes which happens as a result of the Christmas and New Year holidays and warned all the Users to be aware and kindly consider the changes and ensure they're taking care of. (all times are GMT+2):

Thursday, December 23

Indices:

• #ESX50 (Europe 50) — trading ends at 23:00

• #GDAXIm (Germany 30) — trading ends at 23:00.

Friday, December 24

Commodities CFDs:

• XBRUSD (UK Brent) — trading closed

• XTIUSD (US Crude) — trading closed

• XNGUSD (US Natural Gas) — trading closed

Metal CFDs:

• XAUUSD (GOLD vs. US dollar) — trading closed

• XAGUSD (SILVER vs. US dollar) — trading closed

Indices:

• #AUS200 (Australia 200) — trading ends at 05:00

• #ESX50 (Europe 50) — trading closed

• #FCHI (France 40) — trading ends at 14:55

• #GDAXIm (Germany 30) — trading closed

• #HSI (Hong Kong 50) — trading ends at 06:00

• #J225 (Japan 225) — trading closed

• #UK 100 (UK 100) — trading ends at 15:00

• #SPXm (US SPX 500 (Mini)) — trading closed

• #NDXm (US Tech 100 (Mini)) — trading closed

• #WS30m (Wall Street 30 (Mini)) — trading closed

Stock CFDs: trading closed.

Monday, December 27

Indices:

• #AUS200 (Australia 200) — trading closed

• #ESX50 (Europe 50) — trading starts at 02:15

• #FCHI (France 40) — trading starts at 09:00

• #GDAXIm (Germany 30) — trading starts at 02:15

• #HSI (Hong Kong 50) — trading closed

• #UK 100 (UK 100) — trading closed.

Tuesday, December 28

Indices:

• #AUS200 (Australia 200) — trading closed

• #HSI (Hong Kong 50) — trading starts at 03:15

• #UK 100 (UK 100) — trading closed.

Wednesday, December 29

Indices:

• #UK 100 (UK 100) — trading starts at 03:00.

Thursday, December 30

Indices:

• #ESX50 (Europe 50) — trading ends at 23:00

• #GDAXIm (Germany 30) — trading ends at 23:00.

Friday, December 31

Commodities CFD:

• XBRUSD (UK Brent) — trading ends at 21:45

Indices:

• #AUS200 (Australia 200) — trading ends at 05:30

• #ESX50 (Europe 50) — trading closed

• #FCHI (France 40) — trading ends at 14:55

• #GDAXIm (Germany 30) — trading closed

• #HSI (Hong Kong 50) — trading ends at 06:00

• #UK 100 (UK 100) — trading ends at 15:00.

Monday, January 3

Indices:

• #AUS200 (Australia 200) — trading closed

• #ESX50 (Europe 50) — trading starts at 02:15

• #FCHI (France 40) — trading starts at 09:00

• #GDAXIm (Germany 30) — trading starts at 02:15

• #HSI (Hong Kong 50) — trading starts at 03:15

• #UK 100 (UK 100) — trading closed.

Tuesday, January 4

Indices:

• #UK 100 (UK 100) — trading starts at 03:00.

All traders are Pleased to consider this information when you plan your trading to avoid any inconvenience that may occur.

The platform mentioned in the article: https://wap.wikifx.com/en/newsdetail/202201052954546232.html

-

1

1

0

0

- Comments

- No comments yet.

- Shareholder | Account: 42 SHARES. +0

-

7468 viewsWIKIFX:  What is trading in Forex?

7468 viewsWIKIFX:  What is trading in Forex?

The simplest answer is MONEY . Meaning national currencies.

Because something is not really bought, the business of change is a bit complicated, so we will use a simple example to help explain it.

You have determined that the purchase money as purchasing shares in a land , like purchasing shares in the fabric.

Pricing usually refers to the market view on the quality of the current and future market economy.

In the foreign exchange market, for example, the Japanese currency (yen), you have no choice but to buy shares in the Japanese economy.

mkr.jpg

You are convinced that Japan's economy is doing well and that there will be future growth.

If you sell these "stocks" in the market, you are expected to make a profit.

In general, exchange rate fluctuations reflect the economic situation of this country on the economies of other countries.

By the time you graduate from Pipsology , you will be ready to work with different national currencies.

Big Money

Just as there are many currencies that you can trade, as a new exchange trader, it is possible to start a business with large "funds".

mkr.jpg

They are called "big currencies" because they are the most traded currencies and some of them represent the largest economy in the world.

Currency traders have disputed over what they call Big Currencies.

As a rule of thumb, law enforcement like children consider the USD, EUR, JPY, GBP, and CHF as major currencies.

They then called the AUD, NZD, and CAD "stocks" .

In our case, the rebels, in order to alleviate the situation, simply call the eight coins "big bucks."

Below, we list them with their symbols, Countries used, currency names and interesting game names.

mkr.jpg

mkr.jpg

Currencies are marked with "three letters" , the first two letters indicate the name of the country in which they are used, and the last letter indicates the currency of the country in which they are used, usually referring to the first letter of the national currency.

These three letters are called ISO 4217 Currency codes .

In 1973, the International Organization for Standardization (ISO) issued three letters as the currency symbols we use today.

mkr.jpg

Take the NZD for example ……

NZ means New Zealand, and D means dollar.

It's easy, isn't it?

The currencies in this map are called “Big Currencies†because they are the most traded currencies.

Do you know? The British pound (pound) is the oldest currency in the world and has been in use since the 8th century. The new currency in the world is the South Sudan Pound, officially confirmed on July 18, 2011.

It is safe to say that buck is not the only name for a USD game.

There are others like: greenbacks, bones, benches, benjamins, cheddar, paper, loot, cheese, bread, moolah, dead president and cash money.

So if you want to say "Now I'm going to work"

You can say, “Yo, I gotto bounce! Gotto make benjis son! â€

Have fun: In Peru, the name of the US dollar game is Coco, the animal name is Jorge (George in Spanish), which means a $ 1 note on George Washington's $ 1 note.

mkr.jpg

They call me Coco yo!

Stem

- Comments

- No comments yet.

- Shareholder | Account: 42 SHARES. +0

-

7176 viewsThe foreign exchange, or Forex market, is arguably the biggest market in the world. It is even bigger than the stock market; according to a 2019 survey done by FX and OTC Derivatives Market, the Forex market has a daily trading volume of $6.6 trillion, and the number is predicted to increase every year. As one of the largest financial markets, Forex trading has the potential for extreme gains and quick returns.

However, there exists a corresponding amount of risks and volatility associated with the market, especially if traders turn to leveraged trading. Leverage enables a trader to open a larger position in the Forex market, without the full amount of investment usually needed. This means that while it is easier to increase your profits, it is also just as easy to magnify any potential losses.

Today, as a modern society, we are continuously exploring options that can essentially improve and make our lives easier. This concept can be similarly applied to the Forex market, as the adoption of advanced technology, such as artificial intelligence, in Forex trading can be the crucial difference between a successful trade and one that fails.

AI in Forex Trading

Artificial intelligence, also known as AI, can take the information or data given and process it in a way that humans can never do. As technology continues to evolve, AI can now process vastly more data at an even greater speed than before.

AI technology helps users track a lot of data, analyse real-time performance, and automate certain trading processes. By incorporating AI technology in the Forex market, traders can secure a significant advantage by evaluating thousands of trading patterns to discover lucrative trade opportunities. This can result in better Forex returns, even if the trader does not possess any significant prior experience.

Think of the Forex market as one of the fiercest battlefields in the world. It is a zero-sum game; for someone to take a long position, a counterparty must be available to take an opposing position. Traders must use every single advantage that they possess, and AI analytics have become an essential tool for any trader to survive in the Forex market. These AI tools use a vast amount of data, market trends, commodity prices, fluctuations etc., to create better trading strategies that can increase your profits and minimize any losses.

While there are a few AI trading tools at the moment, it can be hard for new traders to discover one that truly works for them. At the same time, some trading tools may charge overly high subscription fees that may seem daunting for traders that do not have high capital. To serve users with varying needs, IPCapital has emerged as a stellar choice for traders with its flexible options for traders of all levels.

The AIA BOT System – An Effective Tool for Forex Trading

IPCapital is an international Fintech company focusing on financial services and technological research and development. With great foresight, the company has been building up its AI capabilities and resources over the years and is well poised to capitalize on the current AI trend within the financial markets.

IPCapital offers 3 different AIA BOT systems that uses AI and machine learning to analyse and predict trading patterns for a wide variety of trading pairs based on algorithms and pre-set technical settings. While it helps execute trades based mostly on short-term arbitrage, traders are free to adjust the existing parameters for day-trading or long-term trades too. It uses over 15 systems for trading analysis, and retains strategies that have a high rate of winning.

By using the AIA BOT system, traders can employ predictive analytical methods and machine learning to predict and take advantage of any market fluctuations. It can also help eliminate emotional or panic trading, as traders may resort to panic selling or make hasty decisions when they find themselves in a pinch. AI-based algorithms would eliminate such weaknesses commonly found in new traders.

Conclusion

AI definitely exceeds the accuracy and speed of a human brain while analysing market conditions and data. It is not surprising then that many traders have given up traditional manual trading strategies for AI driven ones. As technology advances each passing day, IPCapital is committed to developing and improving existing technologies, and strives to provide an easier trading and investment experience for all users, to help them build stronger and more profitable trading strategies.

Intelligence Prime Capital – https://iprimecapital.com/.

The brokers involved in the article: https://apphtml.wikifx.com/news/newsdetail?countryCode=ng&languageCode=en&code=202201042444199941

-

0

0

1

1

- Comments

- No comments yet.