Breaking News

-

REDD SKOGEN AS

Giant Sequoia Seedbox is now for sale nationwide in Norway. Giant Sequoia goes by many different names. Botanically it’s known as Sequoiadendron Giganteum. In Norway, the specie is often known as Mammut tree, and historically by [...] -

Magnus Dagestad

Drinking horn with richly carved loop ornamentation and band with geometric decoration. The horn is held up by a dragon. Carved signature and date on the underside of the tail: Woodworker Magnus Dagestad, Voss 1897. [...] -

Apple is working on a completely new Jesus Phone

The Information was one of the first to leak Vision Pro several years ago, and they revealed quite a bit last January. Now they are back with very interesting information about a brand new generation [...] -

Listhaug Wants to Prepare Norway for War with Oil Money

There is every reason to fear another major war, says Frp leader Sylvi Listhaug. Irresponsible way of speaking, replies Prime Minister Støre. Almost two years after Russia’s full-scale invasion of Ukraine, Frp leader Sylvi Listhaug [...] -

Deepwater Titan

Do you have $370,000,000? Deepwater Titan is up for sale @ Frontline 2012. Check out the listing now. Specs: Design / Generation Jurong Espadon JE3T Ultra Deepwater Drillship Constructing Shipyard Jurong Shipyard, Pte Ltd, Singapore [...]

Baidu Norway

Baidu Chairman and CEO Robin Li welcomes his new staff in Norway. Baidu, Inc. (/ˈbaɪduː/ BY-doo; Chinese: 百 度; pinyin: Bǎidù, meaning “hundred times”) is a Chinese multinational technology company specializing in Internet-related services, products, […]

Now on Vidileaks! Rouge Trader (1999)

Ambitious, wide-eyed boy Nick Leeson (Ewan McGregor) is determined to rise in the world and be more than a simple bank clerk. When his employers, Barings Bank, offer him the opportunity to go to Jakarta, […]

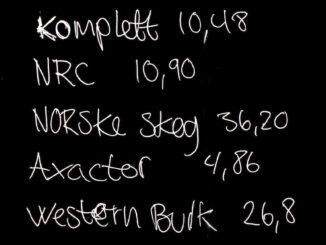

The Hitlist On Oslo Stock Exchange

We have been asked for stock tips on the Oslo Stock Exchange for a long time and by several institutions, so here they are: Komplett Group AS is the Nordic region’s largest online retailer with […]

Jystad Corp Acquires Bankrupt Opticom ASA in Hostile Takeover

Opticom was established in 1994. The research and development work in the company was led by Hans Gude Gudesen, and with Gudesen on the ownership side were the two British investors Robert Keith and Thomas […]

Hi-fi Huset Wakes Up From The Dead

Hi-Fi Huset is up and running again, and now with new owners. We have an exclusive right for speakers from Spirit Technologies and will focus on products from this speaker manufacturer. Spirit Technologies is an […]

REDD SKOGEN AS

Magnus Dagestad

Apple is working on a completely new Jesus Phone

Listhaug Wants to Prepare Norway for War with Oil Money

Deepwater Titan

StockRants Refresh Underway

StockRants was launched shortly after the 2008 stock market crash as a friendly place where investors or traders could meet and discuss the markets, investing, and other strategies. Now that we’ve ridden through, arguably, the buckingest bull market in history, what’s next for 2011? How about a refresh for Stockrants!

We’ll be rolling out changes and features slowly over the next few weeks.

The World MoneyShow Comes to Vancouver

The World MoneyShow is coming to Vancouver September 19-21, 2011. At the expo you can meet face to face with leading investment experts and maybe even get answers to your most burning financial questions.

Discover cutting-edge investment opportunities and gain insight on how to best position your portfolio for profit, in 2011 and beyond. […]

OptionsHouse Review: Plus Trade Free for 60 Days

OptionsHouse is a favourite for those looking to get great contracts at some of the best prices in the industry. Like most options brokerages rates are structured to be a better value for active traders, and transaction prices recently got changed from $3.95 to $4.95 per trade.

Even with the increase this is still pretty much the best price in the industry. Personally I find my trading dollar goes a lot further at OptionsHouse. […]

Updates to StockRants Sept 19th, 2011

I hope investors are enjoying the summer as well as the deep discounts the market has once again presented us with. Lots of great opportunities to start building a portfolio rolling into the final quarter of 2011.

We’ve made some updates to StockRants under the hood and wanted to post a quick update detailing the changes. We also have an announcement regarding submitting articles or other contributions. […]

Preview: Zecco Trading Center Refresh

Zecco has a sleek new trading platform going into a pilot period with select users this week. I had a chance to get a preview and take a glimpse of a few of the updates and wanted to share them with you here.

Zecco is a discount online broker featuring $4.95 equities and 65¢ options trades. Check with Zecco for the latest promotions. […]

-

Nasdaq listed Rockwell Medical on a flight to Space

-

Kitty at work in Estonia

-

Technology

TechnologyThe Machines are Here: Year 2027

-

Semi-Submersible for Sale: MUSD 190

-

SAS Needs MNOK 9500! Lol

-

Featured

FeaturedSeadrill: Back in Black

-

Featured

FeaturedThe Human Heart

-

New Radioactive Drug Can Detect Alzheimer’s

-

Nuclear Warhead

-

CHAIRMAN FSH-60

Point of No Return

Language bots have taken the world by storm this winter. Chinese companies have been world leaders in the development and commercialization of artificial intelligence. Now they can be left behind. Chinese authorities have been clear […]

Five Things in the News That Can Affect the Stock Market

Investors would like to accurately predict the stock market to exploit the available profitable economic opportunities. However, various economic trends and extraneous factors affect this perfect strategy as they indicate the success and failure of […]

StocksToTrade Review: A Market Intelligence Tool That Takes the Gamble Out of Stock Trading

Thanks to new fintech solutions such as Robinhood, Ally Invest, and eToro, it is now incredibly easy for anybody to participate on Wall Street as a trader on an investor. However, stock trading is a […]

Shell (RDS.A) Resumes Work at Prelude Floating LNG Facility

Royal Dutch Shell plc RDS.A recently confirmed that it resumed activities at Prelude floating liquefied natural gas (LNG) facility offshore Western Australia. The facility remained offline since February due to engineering glitches. This suspension followed an order from Australia's upstream regulator to perform additional work following three safety incidents that took place at the facility between September and January. […]

Credit Acceptance Gains on Consumer Loans and Active Dealers

Supported by a decent increase in consumer loans along with a rise in dealer enrollments, Credit Acceptance Corporation 's CACC revenues are anticipated to improve in the near term. Moreover, its share buyback policy remains impressive, through which the company is expected to continue enhancing its shareholder value. […]

Nasdaq listed Rockwell Medical on a flight to Space

Kitty at work in Estonia

The Machines are Here: Year 2027

Semi-Submersible for Sale: MUSD 190

SAS Needs MNOK 9500! Lol

Airline Stock Roundup: UAL’s Expansion Update, GOL’s August Traffic Report & More

AVEO’s NDA for Fotivda on Track, FDA Verdict Due Next Year

Mastercard, Its Partners and ADB to Cushion Small Businesses

Noblis Acquires Cloud and Analytics Capabilities of Inductive Minds

Petrobras Discovers High Productivity at Jupiter Oilfield

Airline Stock Roundup: UAL’s Expansion Update, GOL’s August Traffic Report & More

In the past week, United Airlines UAL announced that due to the uptick in air-travel demand, it plans to increase its October flying schedule to 40% of its full schedule from 34% in September. Taking advantage of this improvement in travel demand (particularly for leisure), Spirit Airlines SAVE too issued an expansion update. Meanwhile, Hawaiian Airlines, the wholly-owned subsidiary of Hawaiian Holdings HA , became the latest carrier to eliminate change fees. […]

AVEO’s NDA for Fotivda on Track, FDA Verdict Due Next Year

On Sep 7, we issued an updated research report on AVEO Pharmaceuticals, Inc. AVEO . […]

Mastercard, Its Partners and ADB to Cushion Small Businesses

Mastercard Inc. MA and partners N-Frnds, SGeBIZ and Finastra have entered into an agreement with the Asian Development Bank (ADB) to provide funds for small and medium enterprises (SMEs) in Asia. SMEs are at the receiving end of the COVID-19-led business disruption, which affected their supply chains and trade networks […]

Noblis Acquires Cloud and Analytics Capabilities of Inductive Minds

Noblis Acquires Cloud and Analytics Capabilities of Inductive Minds Skills and knowledge will enhance Noblis’ portfolio of DoD and national security expertise PR Newswire RESTON, Va., Sept. 8, 2020 RESTON, Va. , Sept […]

Petrobras Discovers High Productivity at Jupiter Oilfield

Petroleo Brasileiro S.A. or Petrobras PBR recently concluded the formation test in the pre-salt exploration area of Jupiter oilfield at the Santos Basin. The outcomes of the same ascertain the high productive capacity of the well, which comprises condensed oil of top-class quality with elevated flow rates, thereby strengthening the prospects of the region […]

Nasdaq listed Rockwell Medical on a flight to Space

Kitty at work in Estonia

The Machines are Here: Year 2027

Semi-Submersible for Sale: MUSD 190

SAS Needs MNOK 9500! Lol

REDD SKOGEN AS

Magnus Dagestad

Apple is working on a completely new Jesus Phone

Listhaug Wants to Prepare Norway for War with Oil Money

Deepwater Titan

Baidu Norway

Now on Vidileaks! Rouge Trader (1999)

The Hitlist On Oslo Stock Exchange

Jystad Corp Acquires Bankrupt Opticom ASA in Hostile Takeover

Hi-fi Huset Wakes Up From The Dead

Nasdaq listed Rockwell Medical on a flight to Space

Kitty at work in Estonia

The Machines are Here: Year 2027

Semi-Submersible for Sale: MUSD 190

SAS Needs MNOK 9500! Lol

Seadrill: Back in Black

The Human Heart

StockRants Community